georgia ad valorem tax 2021

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. The two changes that apply to most vehicle transactions are.

Tax Rates Gordon County Government

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

. This tax is based on the value of the vehicle. The actual filing of documents is the veterans responsibility. Georgia passed a revision of the TAVT tax law in 2019 that reduced the rate from 70 to 66 and will go into effect January 1 2020.

In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. All Georgia communities can provide partial relief and some can provide full exemptions from ad valorem taxes for certain privately-used facilities through bond-lease transactions. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides.

Ad Looking for ad valorem tax georgia. Content updated daily for ad valorem tax georgia. Georgia law amends provisions relating to sales tax.

Updated April 6 2021. The tax must be paid at the time of sale by Georgia residents or within six months of. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or.

Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a statewide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers to provide for a referendum to provide for effective dates. Georgia Ad Valorem Tax Incentives Through Bond-Lease. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

For Georgia car leases the new one-time TAVT means no separate sales tax on down payment no sales tax on monthly lease payments and no more annual ad valorem property tax which had been the practice in the past. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Georgia law requires each county levying and recommending authority to provide certain disclosures to taxpayers prior to the establishment of the annual millage rate for ad valorem tax purposes.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Annual Notice of Interest Rate Adjustment 8577 KB ADMIN 2021-01 - Annual Notice of Interest Rate Adjustment 8564 KB ADMIN 2020-01 - Annual. Georgia HB1334 2021-2022 A BILL to be entitled an Act to amend Article 10 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to ad valorem taxation of motor vehicles and mobile homes so as to include tiny homes on wheels in the definition of mobile homes to define the term tiny home on wheels to provide that mobile homes shall be returned for taxation.

For the answer to this question we consulted the Georgia Department of Revenue. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Turbotax is not counting my Georgia ad-valorem tax.

Local state and federal government websites often end in gov. If itemized deductions are also. 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle.

The TAVT rate will be lowered to 66 of the fair market value. Georgia does have a separate TAVT tax which is not deductible but for trailers and vehicles registered before the law they are still charging a tax based on the value of the vehicle which should be deductible. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

And a timely Order can be issued by Commissioner authorizing the billing and collection of ad valorem taxes. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Make sure you get your childs 3600 child tax credit line 28 as well as the 1400 EIP3 payment line 30 if you had a child in 2021.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years. A Georgia state law that went into effect on May 4 2021 amends provisions relating to the joint county and municipal sales and use tax by providing for the levy of the tax by consolidated governments.

Get the estimated TAVT tax based on the value of the vehicle using. Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to expand an exemption for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities to add dairy products. This ability can be used as an incentive to induce the location of a new business or the expansion of an existing.

Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. The IRS didnt know about your future child obviously so it was not included in any EIP stimmy checks or if they deposited some of child tax credit into your bank in the second half of 2021.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.

Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the. TAVT Annual Ad Valorem Specialty License Plates. Georgia HB837 2021-2022 A BILL to be entitled an Act to amend Chapter 5 of Title 48 of the OCGA relating to ad valorem taxation of property so as to provide for a homestead exemption from ad valorem taxes for all purposes in an amount equal to 500000 of the assessed value of the homestead for residents whose federal adjusted gross income as well as the federal.

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Ad Valorem Tax on Vehicles.

Please provide a solution so I. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax.

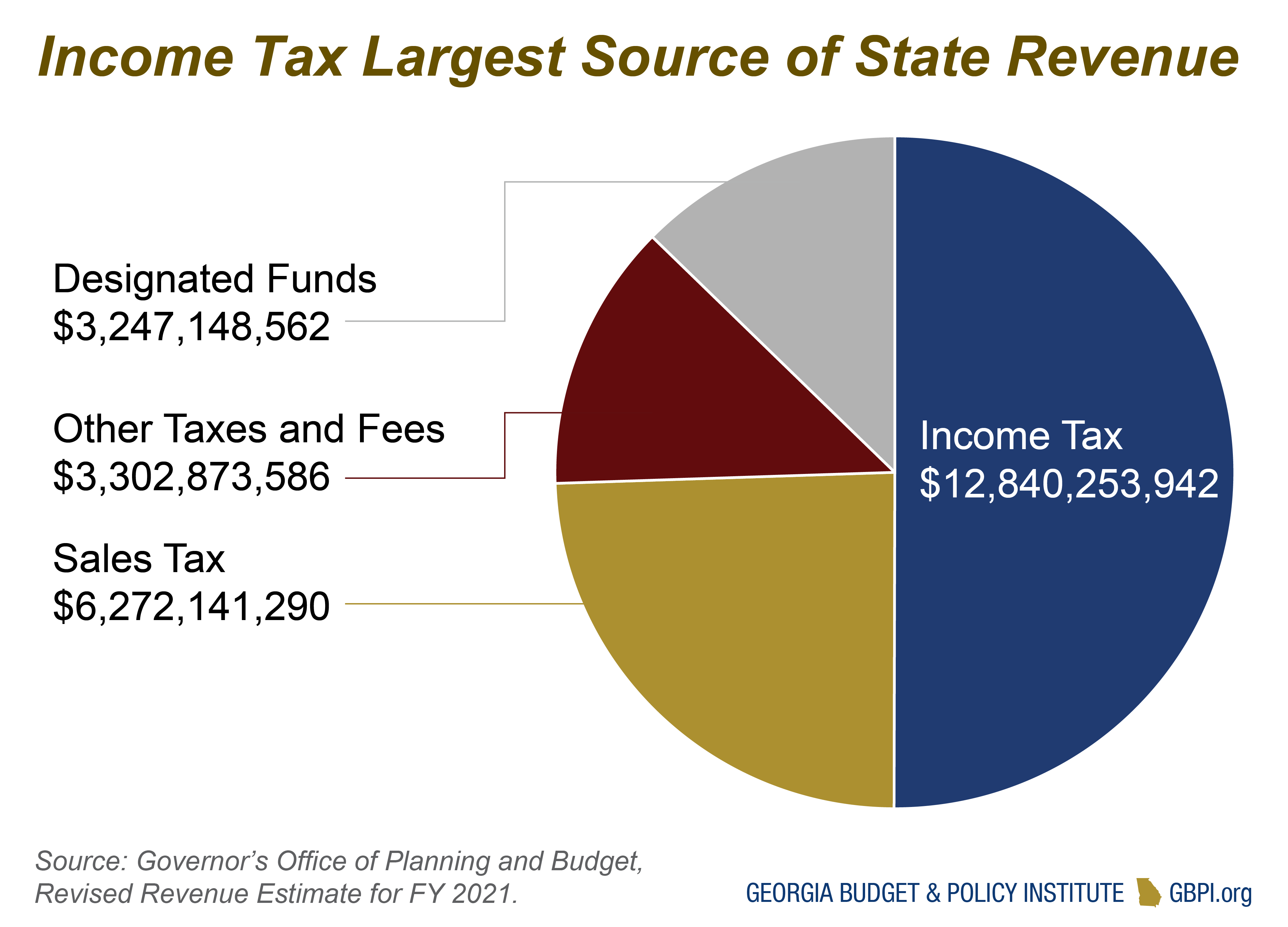

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Money Matters Buying A Home Teresa S Step By Step Basics In 2021 Home Buying Money Matters Second Mortgage

Property Taxes Laurens County Ga

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 Los Ange Property Tax Natural Disasters Tax Rules

Market Stats October Real Estate Marketing Local Real Estate Marketing Stats

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Sales Tax Small Business Guide Truic

Ranking Based On Home Values Property Taxes Home Ownership Rates And Real Estate Statistics Best Art Schools School Fun Georgia College

Georgia Used Car Sales Tax Fees

Risultato Della Ricerca Immagini Di Google Per Http Www Uppitorino It Immagin Property Tax Georgia Properties Home Icon

Pin By Melissa Shortt On Aveda Oconee Embarcadero Aveda

542 Henry Higgins Rd Jackson Ga 30233 3645 Lhrmls 00873684 Lakehomes Com In 2021 Waterfront Property Real Estate Houses Vinyl Exterior

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes